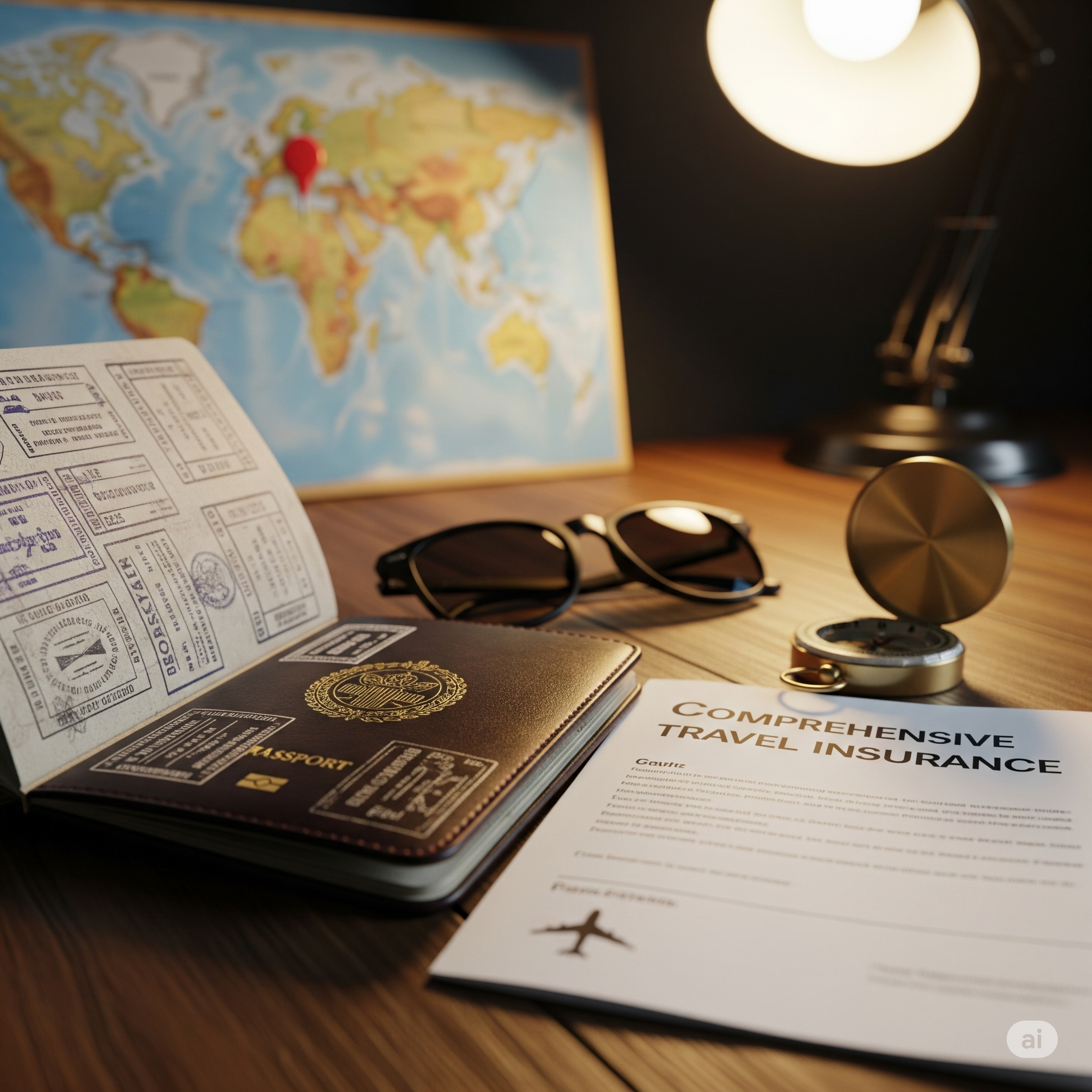

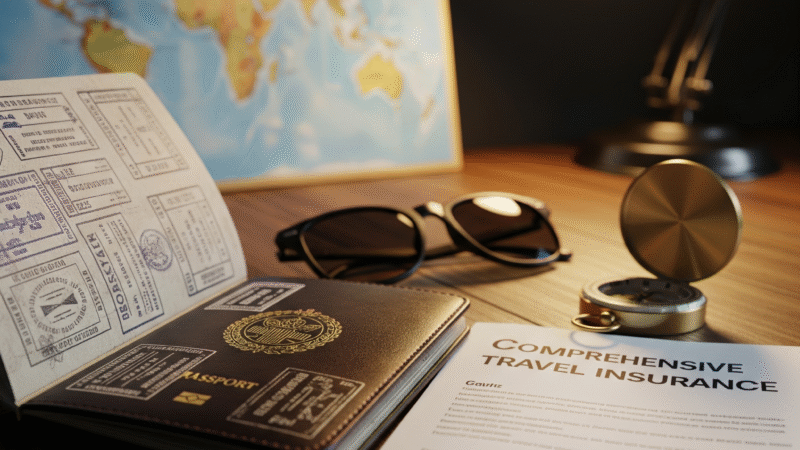

Embarking on an international adventure or even a domestic getaway should be an exciting prospect, filled with anticipation for new experiences. However, unexpected events can occur, from medical emergencies and trip cancellations to lost luggage. This is where travel insurance USA residents can rely on for a safety net, providing financial protection and peace of mind. Choosing the right policy, however, requires careful consideration. This comprehensive guide will walk you through the essentials of travel insurance USA, helping you understand the different types of coverage and how to select the best option for your specific travel needs.

Understanding the Fundamentals of Travel Insurance USA

Before delving into specific policies, it’s crucial to grasp the core components that make up travel insurance USA plans. These policies are designed to protect you from a range of unforeseen circumstances that can disrupt your travel plans and incur significant costs.

Trip Cancellation and Interruption Coverage

One of the most common reasons individuals purchase travel insurance USA is to protect their financial investment in their trip. Trip cancellation coverage can reimburse you for non-refundable prepaid travel expenses if you are forced to cancel your trip due to covered reasons, such as sudden illness, injury, or the death of a family member. Trip interruption coverage provides similar benefits if your trip is unexpectedly cut short after it has already begun. This could cover the cost of a last-minute flight home and reimbursement for unused portions of your prepaid arrangements.

Emergency Medical Coverage: A Critical Component for International Travel

While your domestic health insurance may offer some coverage when you travel within the United States, it often has limited or no coverage abroad. Emergency medical coverage, a vital aspect of travel insurance USA for international trips, can cover expenses related to medical emergencies, including doctor visits, hospital stays, emergency transportation, and even repatriation if necessary. This coverage is especially important when traveling to countries where healthcare costs can be exorbitant. For US citizens planning international trips, ensuring robust medical coverage within their travel insurance USA plan is paramount.

Baggage and Personal Belongings Coverage

Losing your luggage or having your personal belongings stolen can be a frustrating and costly experience. Baggage and personal belongings coverage, typically included in comprehensive travel insurance USA policies, can help reimburse you for the cost of lost, stolen, or damaged luggage and personal items. While the reimbursement amounts usually have limits, this coverage can alleviate the financial burden of replacing essential items while you are traveling.

Key Considerations When Choosing Travel Insurance USA

Selecting the right travel insurance USA plan involves more than just comparing prices. You need to carefully assess your individual travel needs and choose a policy that provides adequate coverage for your specific circumstances.

Assessing Your Destination and Activities

The type of coverage you need can vary significantly depending on your destination and the activities you plan to participate in. If you are planning a relaxing beach vacation, your primary concerns might be trip cancellation and medical emergencies. However, if you are engaging in adventure sports like hiking, skiing, or scuba diving, you will want to ensure your travel insurance USA policy covers these activities, as many standard plans exclude them. For example, if you are considering a trip involving more adventurous activities, it’s worth checking if your chosen plan aligns with the advice offered in resources discussing comprehensive travel safety.

Evaluating Coverage Limits and Deductibles

Carefully review the coverage limits for each benefit in your travel insurance USA policy. Ensure that the limits are sufficient to cover potential costs. For instance, if you are taking an expensive cruise, you will want to ensure that your trip cancellation coverage limit is high enough to reimburse the full cost of your trip. Also, pay attention to the deductible, which is the amount you will have to pay out-of-pocket before your insurance coverage kicks in. A lower deductible usually means a higher premium.

Understanding Exclusions and Pre-existing Medical Conditions

Every travel insurance USA policy has exclusions, which are specific situations or events that are not covered. Be sure to carefully read the policy wording to understand these exclusions. Common exclusions include losses resulting from pre-existing medical conditions (unless specifically covered by a waiver), acts of war, and participation in certain high-risk activities. If you have any pre-existing medical conditions, it’s crucial to look for a travel insurance USA policy that offers a waiver for these conditions, often requiring the policy to be purchased within a specific timeframe after your initial trip booking. Resources like this guide on finding a qualified electrician might seem unrelated, but the principle of thoroughly understanding exclusions before committing to a service is universally applicable.

Navigating the Market: Finding the Right Travel Insurance USA Provider

With numerous travel insurance USA providers available, it’s essential to do your research and compare different options before making a purchase.

Comparing Quotes from Multiple Providers

Don’t settle for the first travel insurance USA quote you receive. Use online comparison websites to get quotes from multiple providers simultaneously. This will give you a good overview of the market and help you identify policies that offer the best coverage at a competitive price. Pay close attention to the details of each policy, not just the premium.

Checking the Provider’s Reputation and Customer Service

Before purchasing a travel insurance USA policy, take the time to research the provider’s reputation and customer service. Look for online reviews and ratings to get an idea of other travelers’ experiences with the company, particularly regarding claims processing and customer support. A reliable provider with good customer service can make a significant difference if you need to file a claim while you are traveling. Insights into reliable service providers, even in different sectors, can often be found by looking at how well companies handle customer issues and maintain their reputation.

Considering Package Deals and Add-on Options

Many travel insurance USA providers offer package deals that bundle various coverages together. Evaluate these packages to see if they meet your needs. You may also have the option to add specific coverages to your policy, such as adventure sports riders or increased baggage limits. Consider these add-on options if your specific travel plans require additional protection. For US citizens planning travel, understanding these nuances is key to securing appropriate travel insurance USA.

By carefully considering your travel needs, understanding the different types of coverage available, and thoroughly researching your options, you can confidently choose the best travel insurance USA policy to protect your travels and enjoy your adventures with peace of mind.