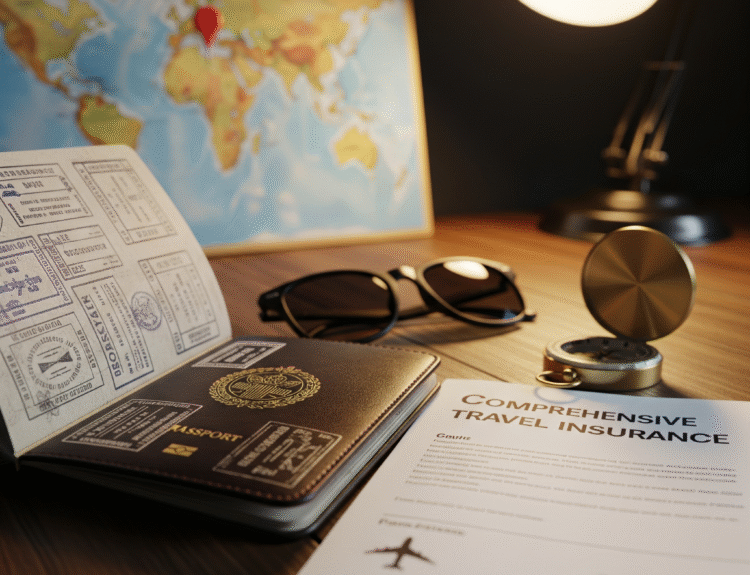

Embarking on a journey, whether it’s a solo trek through the mountains or a relaxing family holiday, should be about creating lasting memories, not worrying about what could go wrong. That’s where a robust safety net comes in. Investing in comprehensive travel insurance USA is the most reliable way to protect yourself from unforeseen events, ensuring peace of mind from the moment you book your trip. This guide will walk you through everything you need to know to choose the perfect policy for your travel style.

What Does Comprehensive Travel Insurance USA Actually Cover?

When you see the term “comprehensive,” it means the policy bundles together a wide range of benefits to cover you in various situations. While plans differ, a quality comprehensive travel insurance USA policy almost always includes a core set of protections that provide significant financial security and logistical support. Before any international trip, it’s wise to check the latest guidance from the U.S. Department of State Travel Advisories to understand the risk profile of your destination, which can help you decide on the level of coverage you need.

A typical comprehensive plan is built on these key pillars:

- Trip Cancellation & Interruption: This is one of the most valued benefits. If you have to cancel your trip for a covered reason (like a sudden illness, family emergency, or job loss), you can be reimbursed for your prepaid, non-refundable trip costs. Trip interruption applies if you’re already on your vacation and need to cut it short, covering the costs to return home and reimbursing you for the unused portion of your trip.

- Travel Delay: If your flight or other carrier is delayed for a specified amount of time, this benefit can reimburse you for necessary expenses like meals and accommodation.

- Baggage and Personal Effects: This coverage helps if your luggage is lost, stolen, or damaged during your trip. It can provide funds to replace essential items, so you’re not left without your necessities. For more on what to pack, check out our Ultimate Adventure Travel Packing List.

Why Emergency Medical is Key for Comprehensive Travel Insurance USA

Perhaps the most critical component, especially for international travelers, is emergency medical and dental coverage. Your domestic health insurance plan often provides little to no coverage outside of the United States. A medical emergency in a foreign country can be incredibly stressful and financially devastating without proper protection.

A comprehensive travel insurance USA policy with strong medical benefits can cover everything from ambulance services and doctor’s visits to hospital stays and prescription medications. For vital health information on your destination, including recommended vaccinations and current health notices, the Centers for Disease Control and Prevention (CDC) is an essential resource.

Furthermore, this coverage almost always includes Emergency Medical Evacuation. If you suffer a serious injury or illness and the local medical facilities are inadequate, this benefit covers the cost of transporting you to a facility that can provide the necessary level of care.

How to Choose the Right Provider

The market is filled with options, and picking the right one can feel overwhelming. The best approach is to compare policies from several different companies. Look beyond the price and carefully read the policy details to understand coverage limits, deductibles, and exclusions.

Reputable review websites are an excellent resource for comparing different providers side-by-side. For instance, the detailed breakdowns on sites like NerdWallet’s Best Travel Insurance Companies can offer clarity on which companies excel in areas like customer service or specific types of coverage.

When choosing, consider these factors:

- Your Destination: Are you traveling to a remote area where medical evacuation might be more likely? A trip to Western Europe may have different insurance requirements than a trek in Southeast Asia. Our Europe Travel Tips Guide can help you prepare.

- Your Activities: If you plan on skiing, scuba diving, or other adventure sports, make sure your policy covers them, as they are often excluded from basic plans.

- Your Trip Cost: Ensure your trip cancellation coverage is high enough to cover all your non-refundable expenses. Planning your trip budget carefully is the first step; see our tips on How to Save for Your Dream Vacation.

By doing your research and matching a policy to your specific needs, you can travel with the confidence that you’re protected against life’s unexpected detours.