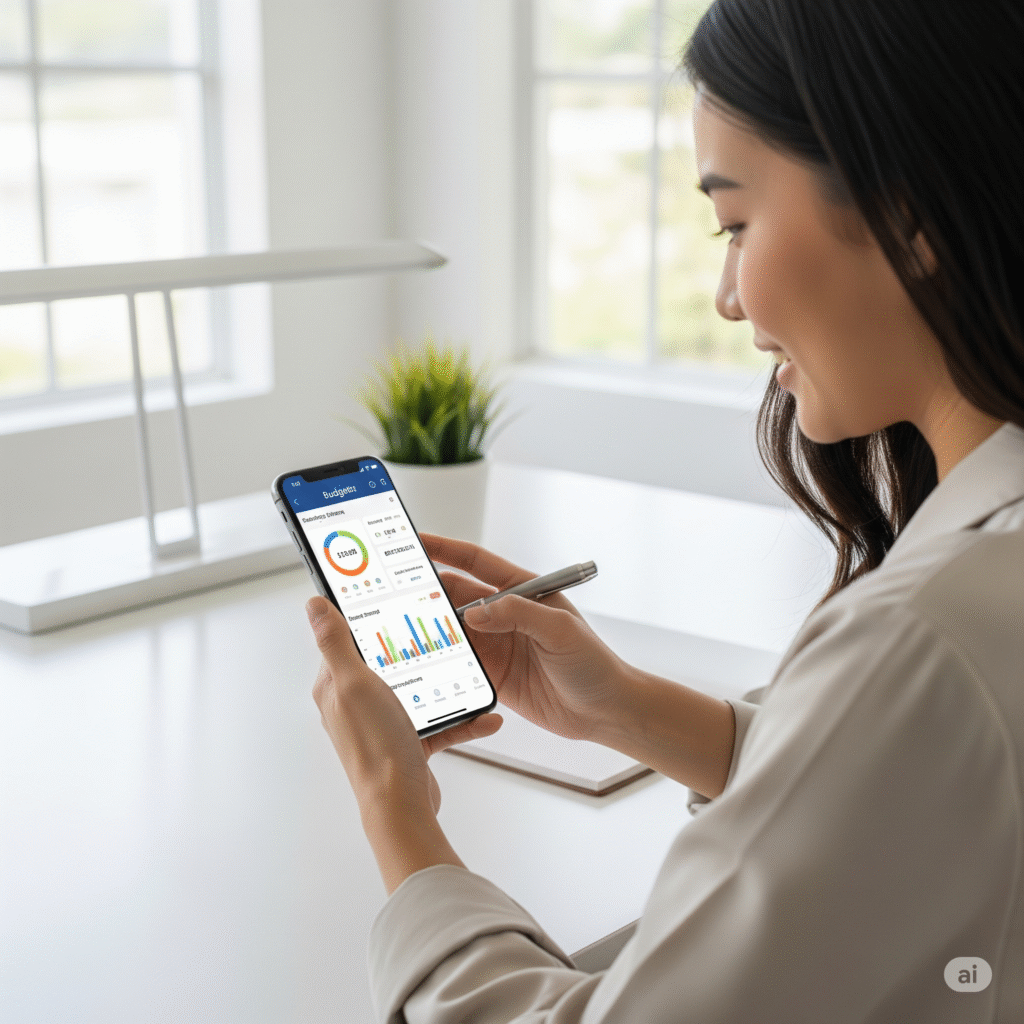

In our modern economy, managing money can feel like trying to catch water in your hands. Income flows in from direct deposits, while money flows out through a dizzying array of automatic subscription payments, contactless purchases, and online shopping. The days of balancing a simple checkbook are long gone, and the humble spreadsheet, while functional, often feels like a chore. This complexity has given rise to a powerful new set of tools: personal finance and budgeting apps.

These apps promise to bring clarity to your financial life, helping you track spending, save more, and crush your goals. But with hundreds of options available, the paradox of choice can be paralyzing. The secret to success isn’t just downloading the most popular app; it’s about finding the one that aligns perfectly with your personality, your financial situation, and your ultimate goals.

This guide will walk you through the process of choosing from the best budgeting apps on the market, so you can find the perfect tool to build a stronger financial future.

Before You Download: Defining Your “Why”

Before you even visit the app store, the most important step is a moment of self-assessment. A budgeting app is just a tool; it’s only effective if it helps you solve a specific problem or achieve a specific goal. Ask yourself these three questions:

1. What is Your Primary Financial Goal? Be specific. Are you trying to:

- Get out of debt? You’ll need an app that helps you track your debts and create a focused payoff plan.

- Save for a big purchase? (e.g., a house down payment, a car, a vacation). Your ideal app will have strong goal-setting and savings-tracking features.

- Stop living paycheck to paycheck? You need an app that gives you a clear picture of your cash flow and helps you manage spending in real-time.

- Invest more consistently? You might want an app that integrates with your investment accounts and helps you identify surplus cash that can be put to work.

2. What is Your Budgeting Style? People approach money differently. The best app for you will match your natural tendencies.

- The Hands-On Manager: You like to be in control and assign a purpose to every single dollar. A detailed, proactive approach like Zero-Based Budgeting is your style.

- The Hands-Off Observer: You don’t want to spend hours categorizing transactions. You just want a clear, automated overview of where your money is going so you can make adjustments.

- The Habit-Builder: You struggle with the discipline of saving and need a tool that makes it automatic and almost invisible.

3. What Features Matter Most to You? Beyond basic budgeting, many apps offer a suite of features. Which of these are must-haves for you? Consider things like bill reminders, credit score monitoring, investment tracking, subscription cancellation tools, and the ability to share a budget with a partner.

The Major Categories: Finding the Best Budgeting Apps for Your Style

Now that you know what you’re looking for, you can explore the main categories of apps. Most fall into one of these distinct styles.

For the All-in-One Financial Picture: Net Worth Trackers

These apps are like a financial command center. They securely link to all of your accounts—checking, savings, credit cards, student loans, mortgages, and investments—to give you a complete, real-time dashboard of your entire financial life.

- Top Example: Empower Personal Dashboard (formerly Personal Capital): While it has budgeting tools, Empower shines in its ability to track your net worth and analyze your investment portfolio. It offers excellent retirement planning calculators and fee analyzers, making it one of the best budgeting apps for those focused on wealth-building and investing.

For the Hands-On, Proactive Budgeter: Zero-Based Budgeting Apps

This philosophy, “give every dollar a job,” requires you to plan for your spending in advance. It’s the most involved method, but it provides unparalleled control over your finances.

- Top Example: YNAB (You Need A Budget): YNAB is the gold standard in this category. It’s more than an app; it’s a methodology built on four rules designed to break the paycheck-to-paycheck cycle. It forces you to be intentional with your money. There’s a learning curve and a subscription fee, but its dedicated users often describe it as life-changing.

For Simplified Tracking and Saving: Automated Expense Monitors

These apps do the heavy lifting for you. They automatically sync with your accounts, categorize your transactions, and provide simple, visual reports on your spending habits. They are perfect for those who want financial awareness without the intensive labor of manual budgeting.

- Top Example: Rocket Money (formerly Truebill): Rocket Money excels at automatically identifying and categorizing your spending. Its standout feature is its ability to find and help you cancel unwanted subscriptions, potentially saving you hundreds of dollars a year. This makes it one of the best budgeting apps for trimming unnecessary expenses.

For Building Good Habits: “Set It and Forget It” Savers

These apps use automation and behavioral psychology to help you save and invest money without actively thinking about it. They are fantastic tools for people who struggle to save consistently.

- Top Example: Acorns: Acorns rounds up your purchases to the nearest dollar and automatically invests the spare change into a diversified portfolio. It makes investing feel effortless and accessible, turning your daily coffee purchase into a small step toward your financial goals.

Key Features to Compare When Choosing from the Best Budgeting Apps

As you narrow down your choices, here are the final criteria to consider.

- Security: This is paramount. Ensure the app uses bank-level security and encryption. Most modern apps use a trusted third-party service like Plaid to securely link to your bank accounts without ever storing your login credentials on their servers.

- Cost and Business Model: How does the app make money?

- Free with ads/recommendations: Some apps are free but will offer you financial products like credit cards or loans.

- Subscription: A monthly or annual fee (like YNAB or Rocket Money Premium) often unlocks more powerful features and provides an ad-free experience.

- Freemium: A basic version is free, with the option to pay to upgrade.

- Ease of Use: The most feature-rich app in the world is useless if you don’t use it. Does the interface feel intuitive to you? Is it easy to navigate and find the information you need? Many apps offer free trials, so take advantage of them.

- Customization and Reporting: Can you create your own budget categories to match your unique spending? Does the app provide insightful reports, like month-over-month spending comparisons, that help you understand your habits and make better decisions?

Choosing one of the best budgeting apps is a powerful first step toward taking control of your financial destiny. By first assessing your personal goals and style, you can confidently select a tool that doesn’t just track your past, but actively helps you build the future you want. Take an hour this week to explore one that feels right—your future self will thank you.